BlockFi filed for bankruptcy in November 2022 and its credit card is no longer available to new applicants.

BlockFi and Gemini are two big names in the crypto industry, and each has released its own credit card product that crypto enthusiasts can appreciate. Here are the differences between each card and our verdict as to which is best.

Payment Network: BlockFi is a Visa Signature Card, Gemini is a World Mastercard

Notice we didn’t just say “Visa” or “Mastercard.” That’s because Visa Signature and World Mastercard have important distinctions and benefits:

Visa Signature Benefits (BlockFi)

- Auto Rental Collision Damage Waiver means you can opt-out of the additional insurance when using your BlockFi card to pay for a rental car.

- Free NortonLifeLock ID Navigator provides you with tools to help prevent identity theft.

- Concierge Services to help you research and book travel, make dining reservations, find event tickets, and more.

- Luxury Hotel Collection Benefits provide a best available rate guarantee, automatic room upgrades when available, VIP guest status, and more.

- Zero Liability Protection for unauthorized transactions made with your card

- Pay-per-use Roadside Assistance available 24/7.

- Global Entry Statement Credit of up to $100 when you use your Visa Signature card to pay the application fee.

- Price Protection reimburses you if an item you purchase with your card is advertised for less within a certain period from the date of purchase.

- Expedited Card Replacement if your card is lost or stolen.

- And more. (This link is to the standard benefits provided by Visa Signature cards, but it’s up to the card issuer, i.e., BlockFi, whether to provide all of these benefits to their customers. For example, Cell Phone Protection is listed as a standard Visa Signature benefit, but there is no indication that BlockFi has included this benefit on its card, which is why we chose not to include it in this list.)

World Mastercard Benefits (Gemini)

- Exclusive Offers on ridesharing, food delivery, online shopping, and more, including 3 free months of DoorDash DashPass and a $5 monthly Lyft credit upon signup.

- Mastercard ID Theft Protection monitors your credit file for fraud and provides notifications about suspicious activity.

- Zero Liability Protection for unauthorized transactions made with your card.

- Cell Phone Protection of $1,000 in yearly coverage ($600 max per claim, 2 claims per year) when you pay your monthly cellphone bill with your World Mastercard.

- Complimentary Travel Services with a “Lifestyle Manager” 24/7 to help with your travel needs.

- Price Protection reimburses you if an item you purchase with your card is advertised for less within a certain period from the date of purchase.

- Priceless Experiences provide access to mostly virtual experiences like cooking lessons and museum tours for free or for a small fee, depending on the experience.

- Mastercard Luxury Hotel and Resorts Portfolio provides amenities and upgrades at more than 3,000 properties around the globe, including complimentary breakfast for two daily, amenity credits of up to $100, and more.

- And more. (This link is to the standard benefits provided by a World Mastercard, but it’s up to the card issuer, i.e., Gemini, whether to provide these benefits to its customers.)

There’s a lot of overlap in these benefits, like fraud protection and travel services, but through different partners. One notable difference is that Mastercard (Gemini) provides a few immediate discounts with DoorDash, Lyft, and ShopRunner, which some cardholders may find appealing.

These cards are accepted everywhere Visa/Mastercard are, which is basically everywhere.

Rewards: BlockFi Pays 1.5% on All Purchases, Gemini Pays Up to 3% in Select Categories

There are a few components to the rewards schemes of these cards, including the rate and how they’re earned, how they’re redeemed, and signup bonuses:

Earning Rates

BlockFi’s rewards are simple — you earn 1.5% back for all purchases. BlockFi offers Rewards Flex, which means you can choose the asset you want to receive your rewards in, and you can change the asset every month. Eligible assets include Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Chainlink (LINK), PAX Gold (PAXG), Basic Attention Token (BAT), Uniswap (UNI), Algorand (ALGO), Bitcoin Cash (BCH) or Dogecoin (DOGE).

Or you can choose to earn stablecoin rewards, including Gemini Dollar (GUSD), USD Coin (USDC), Paxos Standard (PAX), Multi-Collateral Dai (DAI), or Binance USD (BUSD), all of which earn the 1.5% rate.

The BlockFi card increases its earnings rate to 2% after you spend $30,000 on the card in a year. But eligible crypto purchases and trades earn 0.25% on up to $500 spent each month, which is a bit of a downer. Why not pay the same 1.5% or 2% rate, BlockFi?

A flat-rate reward of 1.5% is comparable to a lot of top cards from major banks, like the Chase Freedom Unlimited or Capital One Quicksilver. But it’s undeniable that the potential rate of return on Bitcoin is much higher, whereas 1.5% cash back from big-bank cards will always be the USD equivalent.

The Gemini card’s rewards are higher on the surface, offering up to 3% back in a crypto of your choosing. You can earn rewards in 60+ cryptos, far more than BlockFi offers. But the card’s rewards are tiered, meaning only certain purchases earn the 3% rate of return and are capped at $6,000 in annual spend, after which you’ll only earn 1% back on all purchases:

- 3% back on dining purchases

- 2% back on groceries (this doesn’t include Walmart or Target purchases)

- 1% back on all other purchases

Tiered rewards require you to strategize your spending to maximize your returns, whereas flat-rate cards are simple in that every purchase earns the same rate.

We generally prefer flat-rate rewards and give the edge to the BlockFi card. But if you only use the card for dining and grocery purchases, the Gemini card may be the better option.

Forbes provides this example rate of return for the Gemini card, based on government spending data:

“Government spending data shows that the typical family in the 70th-percentile of wage-earners spends $4,406 on restaurants and $5,687 on groceries per year. Earning 3% on dining and 2% on groceries would result in $245.92 earned which would be converted to the cryptocurrency of your choice in real time. The remaining 16,317 would earn $163.17 for a total of $409.09 in crypto.”

And this example rate of return for the BlockFi card:

“Government spending data shows that the typical family in the 70th-percentile of wage-earners spends $26,410 on their credit cards per year. If a family put all purchases on the BlockFi Bitcoin Rewards credit card they would earn about $396.15 which would be converted to Bitcoin at the prevailing exchange rate each month. Because Bitcoin is volatile, the total amount of rewards earned in a year would vary with the price of Bitcoin and could be significantly more or less than this amount.”

Redemptions

You need to sign up for a BlockFi or Gemini account to receive your rewards. If you’re already a customer of one or the other, this alone may sway you to sign up for that platform’s respective card.

BlockFi rewards are earned as points that are converted monthly on the second Friday of each month at the asset’s current value. Gemini rewards are deposited as crypto into your Gemini account in real time.

Real-time deposits make it easier to gauge the value of your rewards, whereas you won’t know the future value of your rewards with BlockFi and will have to wait to see what your returns actually yield due to the inherent volatility of crypto.

Bonuses

The Gemini Credit Card is offering a limited-edition animated ETF for cardholders who spend $1,500 in their first month following card activation.

The BlockFi Rewards Visa Card doesn’t currently offer a traditional signup bonus, but it does provide a few other ways to earn crypto:

- Trading Bonus: The BlockFi credit card makes trading on BlockFi even more rewarding. Cardholders who trade eligible cryptocurrencies on the platform will earn 0.25% of their trading volume back in Bitcoin, up to a maximum of $500 in BTC every single month. Trade more, earn more bonus bitcoin—it’s that simple. Note: stablecoin to stablecoin trading is excluded from this bonus.

- Refer-a-Friend Bonus: Cardholders who make successful referrals to BlockFi earn an extra $30 in Bitcoin for each friend they refer, on top of the base Refer-a-Friend program. With this bonus, clients can earn $40 in Bitcoin for each of their first four referrals and up to $50 in Bitcoin for each referral thereafter. Best of all, there’s no limit to how many referrals clients can make and how much in bitcoin referral bonuses they can earn.

We like the real-time deposits in a crypto of your choosing offered by the Gemini card, but the BlockFi card offers more ways to earn crypto and is generally easier to manage due to the flat-rate nature of the rewards.

Annual Fee: Neither Card Charges an Annual Fee

The BlockFi card was originally announced with a hefty $200 annual fee. That would have led us to immediately name the Gemini Mastercard the better option.

But since dropping the annual fee, both cards are equally worth consideration, given the generous rewards and Visa/Mastercard benefits.

APRs: BlockFi Charges 17.99% to 27.99%, Gemini 15.99% to 26.99%

The respective 15.99% and 17.99% APRs are designated for consumers who have high credit scores. The 26.99% and 27.99% APRs are for those who are approved with lower credit scores.

You still need good credit to be approved for these cards (more on that in the next section). The term “lower” is relative to the minimum credit score the issuing bank will accept.

If you can manage paying off your credit card every month, the APR doesn’t matter. But if you carry a balance month to month, find a different credit card.

If you simply look at the percentages, 15.99% to 27.99% interest > 1.5% to 3% rewards.

That means your interest charges will eat away at any rewards you earn if you carry a balance. Look for a low-rate credit card from a credit union or a card with a 0% APR on new purchases instead. You never want to take on high-interest debt for the sake of earning credit card rewards.

Unfortunately, neither the BlockFi nor Gemini card offers a 0% introductory APR, but that may change in the future. Credit card terms change pretty regularly, and if demand for the cards is lower than anticipated, the issuers will find ways to make the cards more enticing to consumers.

That said, the difference in APR for these cards isn’t going to make or break your bank and shouldn’t be a huge consideration as to which card you choose.

Approvals: Both Require Good to Excellent Credit for Approval (A FICO Score of About 670+)

BlockFi states right on its website that “Approval is typically reserved for people with credit score ratings of ‘Good’ through ‘Excellent’, but you are always welcome to apply no matter what your credit score is.”

It then goes on to say that “There is generally a minimum credit score of 680 [required], however even a score of 680 could be denied based on additional parameters.”

The Gemini credit card has similar requirements, which are apparent in the fact that it’s a World Mastercard. People with poor credit scores generally can’t qualify for World Mastercards or Visa Signature cards.

While your credit score is an important approval factor, other considerations include your income and credit history. For example, recent late payments or defaulted accounts on your credit reports are likely to disqualify you from being approved for these cards.

Both cards let you see whether you pre-qualify before applying. Pre-qualifying doesn’t affect your credit score and will give you a good idea of your approval odds, but pre-qualification is never a guarantee that you’ll be approved.

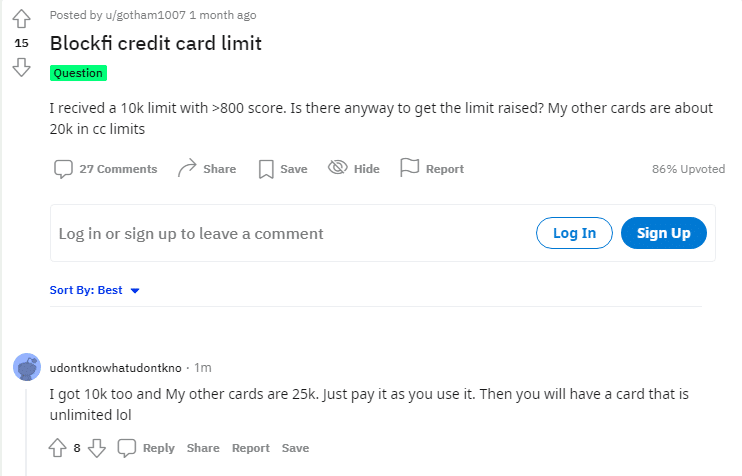

Credit Limits: BlockFi Caps Limits to $25,000, Gemini Unknown but Likely Similar

Card issuers don’t usually say outright say what their minimum and maximum credit limits are, but BlockFi did just that—its maximum available credit limit is $25,000. As for its initial credit limit, I got preapproved for the card with a $15,000 credit limit. A reddit thread indicated some applicants were approved with $5,000 and $10,000 initial limits.

As for Gemini, I haven’t personally applied for this card, but another applicant said, “When I applied I’m pretty sure it said the lowest limit is $2,500 and the highest is $25k,” in this reddit thread. Another said they were approved with a $20,000 initial limit.

Gemini does not yet accept requests for credit limit increases.

Appearance: Both Cards Are Metal, But Gemini Lets You Choose Your Color

The BlockFi card is a black metal card with a blue trim along the edge. It has the BlockFi and Visa Signature logos on the front.

The Gemini Credit Card is also metal, but you can choose between silver, black, or rose gold. It also has the Gemini and Mastercard logos on the front, no matter which color you choose.

We give the edge to Gemini here, just for the sake of customization.

Verdict: BlockFi for Its Simple Rewards and No Spending Caps

As far as interest rates, fees, and eligibility criteria, the differences are negligible. Where the cards really vary is their rewards earning structure and how they’re paid out.

The Gemini card offers tiered rewards of up to 3% on dining purchases, and rewards are paid daily. That’s good and all, but you’re limited to earning 3% on up to $6,000 spent annually. That’s $500 a month, which may be fine for most, but I’d rather not worry about tiered spending categories and limitations. I choose the unlimited flat-rate rewards on every purchase offered by the BlockFi card.