Cryptocurrencies are a revolutionary asset class complete with inside jokes and hard-to-decipher memes. HODL is perhaps the most famous crypto meme and was born of a spelling error.

HODL refers to the investing strategy of holding wherein investors buy and hold their investments rather than trade them. Just as you might expect, the term’s origins are rooted in an old forum post.

A Misspelling of Hold: The History of HODL

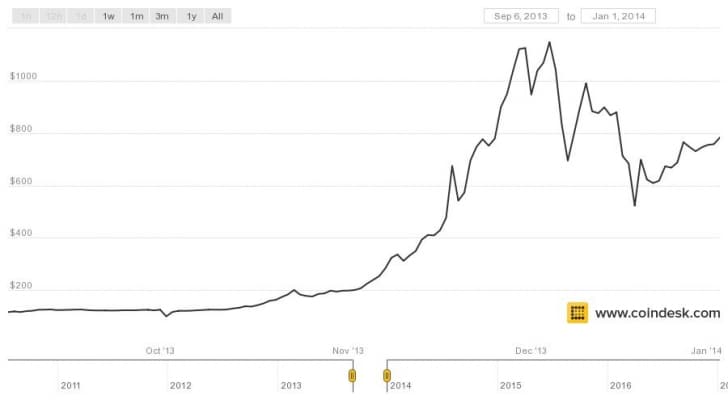

In 2013, the price of Bitcoin soared from double digits to over $1,000. Early BTC investors were shocked, awed, and a little nervous about losing their gains after essentially being made rich overnight.

Just as 2013 was coming to a close, Bitcoin markets tanked, causing BTC to shed hundreds of dollars’ worth of value. Losses mounted to just under -40%, leading weak-handed traders to quickly head for the exit while others posted their strategies to Bitcointalk, a popular BTC trading forum.

In a now-infamous post, GameKyuubi (drunkenly) announced his plans just as BTC was crashing and burning. “I AM HODLING,” was GameKyuubi’s message to the world, followed by various references to being drunk, and why it is important to hold rather than sell when you’re a bad trader.

Now, just as then, HODL memes abound. Twitter, Instagram, and Reddit are full of memes paying homage to HODL as both a crypto cultural reference point and a legitimate trading strategy.

Is HODL a Good Investment Strategy?

While it’s easy to portray the idea of HODLing one’s crypto investment as nothing but a joke, there is real substance to the concept. What HODLing comes down to is this: Hold your investments through both bull and bear markets and commit yourself to a specific investment timeframe.

If you are a novice trader, this tactic is especially useful, since it is unlikely you will trade successfully without having experience or technical trading knowledge. Bitcoin’s vicious price swings have been known to go $1,000+ in either direction within a single day, creating treacherous conditions for all but the best pro traders.

By holding your investments rather than attempting to swing trade them, you cut through most of the cryptocurrency market’s daily noise. Bitcoin investing is subjected to FOMO and FUD cycles that, accordingly, correspond to bull and bear markets. HODLing helps traders avoid buying market tops and selling market bottoms—protecting profits in the process.

As a strategy, HODL is especially preferred by those with strongly positive views about the future of blockchain technology and cryptocurrencies. Those who believe Bitcoin will replace cash, or that Ethereum smart contracts will replace most mediated processes, tend to buy crypto, place it in storage, and let it ride for long periods of time.

Another advantage of HODLing is the ability to earn interest on your crypto while you’re in it for the long haul. If your assets are stored in a digital wallet anyway, why not put them in a secure, interest-bearing account? Some platforms offer up to 12% interest on your assets, but your actual return will depend on the platform you choose and the asset you store.

The HODL Effect

Cryptocurrency investors often implore each other to HODL through hard times. If investors form a community around a project and mutually agree to hold, regardless of market conditions, then the likelihood of the asset remaining stable is greater.

However, there are few examples of communities banding together to such effect. During both bear market capitulations and moments of bull run euphoria, investors tend to SODL (popular misspelling of ‘sold’ influenced by HODL) out of fear.

For Bitcoin maximalists and crypto diehards, holding on for dear life (popular HODL acronym reference) is the only path to the moon.